When you buy/sell gold what exposure to macro economic forces do you get? We think there are primarily two factors that will influence the performance of gold in the long term:

1) What will happen to the attractiveness of keeping money in paper currencies in general

For hundreds of years people have seen gold as a store of value. For a long time, it was used as a currency in itself and then when paper money was created it was what backed the paper money. All through out the period when the world was on the gold standard, the reason people thought paper currency had any value is because they believed that they could exchange that paper currency for gold.

People today continue to see gold as a store of value, even though no currency is backed by gold. Industrial uses of gold make up a small percentage of its demand every year and most of the people who own and store gold see it as a way to preserve their wealth. This is true for those who buy gold in the form of jewelry, private investors and even central banks. We have made this argument before elsewhere in more detail and won’t discuss it more here.

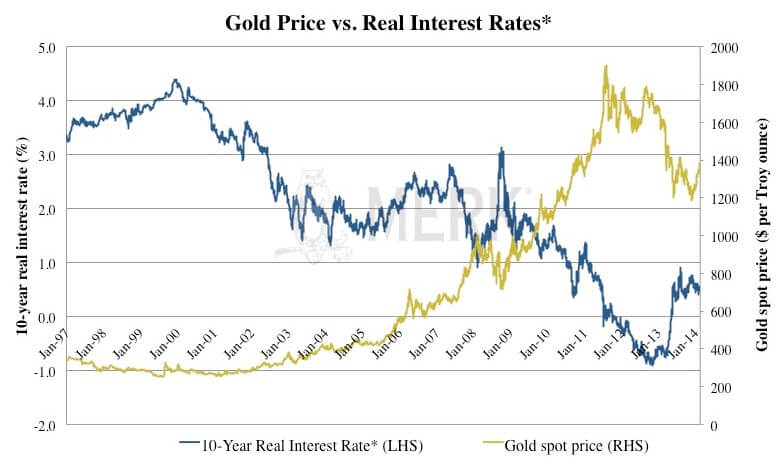

What this all means is that gold effectively competes with other currencies as a store of value. The advantage of gold is that it cannot be created out of thin air, unlike paper currency which can be printed and may sometimes have a high inflation rate. The problem with gold is that it does not yield anything and in addition you have to pay money to store it. On the other hand, if you have your money in paper currency such as the US dollar, you can earn an interest rate by keeping the money in the bank or by buying government bonds. Therefore, one way to assess the attractiveness of paper currency is to look at its real interest rate (the interest rate you can obtain for the safest investments adjusted for inflation). We’ve discussed this in more detail elsewhere.

If real interest rates in paper currencies are very low or negative, you might expect gold to to become comparatively attractive to investors, while if real interest rates in paper currencies are high you might expect the comparative attractiveness of paper currencies to increase. Over the last decade, the increasing price of gold has corresponded with low real interest rates in the US (and across the world). The chart below shows the real interest rates in the US (3 Month Tbill Rate – CPI % Chg YOY) along with average real interest rates in the UK, Europe and Japan, along with Gold Prices. Since the US Dollar is the world’s reserve currency and is considered a safe haven amongst paper currencies, its real interest rate is arguably more important than that of other paper currencies. In any case, you will notice that the circles in red (periods of low real interest rates in the US) often occur at the same time as increases in Gold prices. You will also notice that over the last few years the increase in Gold prices has coincided with negative real interest rates in the US and across the world.

So the big picture is that when you buy/sell gold you are partially making a bet on the future relative attractiveness of gold vs. paper currencies. If you measure the attractiveness of paper currencies as the real interest rate they yield, then you are making a bet on the future interplay between inflation and interest rates. If real interest rates in the world continue to be low, then you might expect gold prices to continue increasing as more people look for a store of their wealth. However, if the real interest rate becomes high, you might expect gold prices to decrease across the world.

2) What will happen to the US dollar relative to other paper currencies

Gold prices are denominated in US dollars and this means that if you are long gold quoted in US dollars you are effectively short the US dollar. This relationship doesn’t have anything to do with demand or supply imbalances between US dollars and gold, its about exchange rates. If there is a market for cars in terms of computers and 1 car = 10 computers, then a halving in the value of computers will cause the price of cars in terms of computers to go up 1 car = 20 computers. That increase in the price of cars had nothing to do with more people with computers wanting to buy cars and driving up the exchange rate. The increase in prices of cars is simply because of the devaluation of computers. Similarly, the exchange rate between Gold and US dollar as of April 1st 2011 is such that 1 oz gold = 1421 US dollars, so a decreasing/increasing value of the US dollar relative to other paper currencies will increase/decrease the price of Gold quoted in US dollars. You can find a more detailed explanation of this relationship between gold prices and the US dollar in a previous post.

In the chart below you will see the historical relationship between Gold prices and the value of the US dollar (relative to other paper currencies). You will notice that several of the periods of falling US dollar value correspond with rising Gold prices.

The big picture is that when you buy/sell gold you are partly betting on the future value of the US dollar relative to other paper currencies (such as the Euro, Yen, British Pound, etc) because gold is denominated in US dollars.

Conclusion

Over the last decade, the real interest in the US and much of the world has often been relatively low and paper currencies have sometimes looked unattractive. At the same time, the US dollar has seen a secular decline in value. This has all corresponded with the price of gold denominated in US dollars to increased almost 4 fold (from about $290 an oz to $1417 an oz).

So when you are buying/selling gold it makes sense to think of it as two bets: one bet on the fate of paper currencies in general vs. gold and the other on the fate of the US dollar vs. other currencies.