There is some disagreement over whether gold should be treated as a commodity or a currency. The reason this distinction matters is that if gold is a classic commodity (i.e something that is mostly consumed for the production of other goods/services) it would make sense to analyse the impact of yearly mining production and industrial demand shocks in order to understand the risk of buying/selling gold. On the other hand, if gold is primarily a currency, then it makes sense to analyze its comparative attractiveness as a alternative to paper currency. In this article, we’ll examine why it does not make much sense to look at gold as a commodity.

Background

By the end of 2010 there were an estimated ~165,000 tons of gold in the world of which 50% is in the form of jewelry, 18% is owned by central banks and the IMF, 18% is owned by private investors, 4% is in some form of industrial use (such as dentistry, electronics, etc) and 2% is unaccounted for.

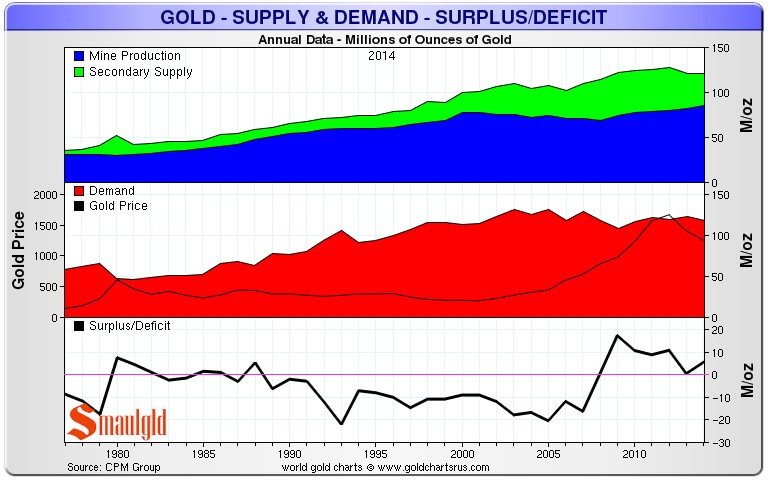

Every year about 4000 tons of gold are on net demanded for one use or another. To meet this net demand for gold, new gold is mined and existing gold is resold to those who demand it such that the demand equals supply. In 2010, 62% of this supply came from mining and the remaining 38% came from reselling existing gold stocks. On the demand side, 53% of the net demand for gold came from jewelry production, 35% came from private investors, 11% came from industrial uses and 2% came from central banks. A more detailed examination of the world’s gold stock can be found in this previous post.

Industrial usage of gold is small

The first thing that is clear from the distribution of gold demand is that it not much of it is used for the production of other goods. Specifically only 11% of yearly gold demand is for industrial uses, compared to 49% for silver. Assuming that it is harder for gold/silver in industrial use to come back onto the market as scrap, this implies that the potential supply of gold that could come onto the gold market as supply is larger than that of silver. This also implies that shocks to the mining supply might be expected to have less effect on the gold price (relative to silver), since there is a larger source of potential supply that can easily enter the market.

Mining production is relatively stable

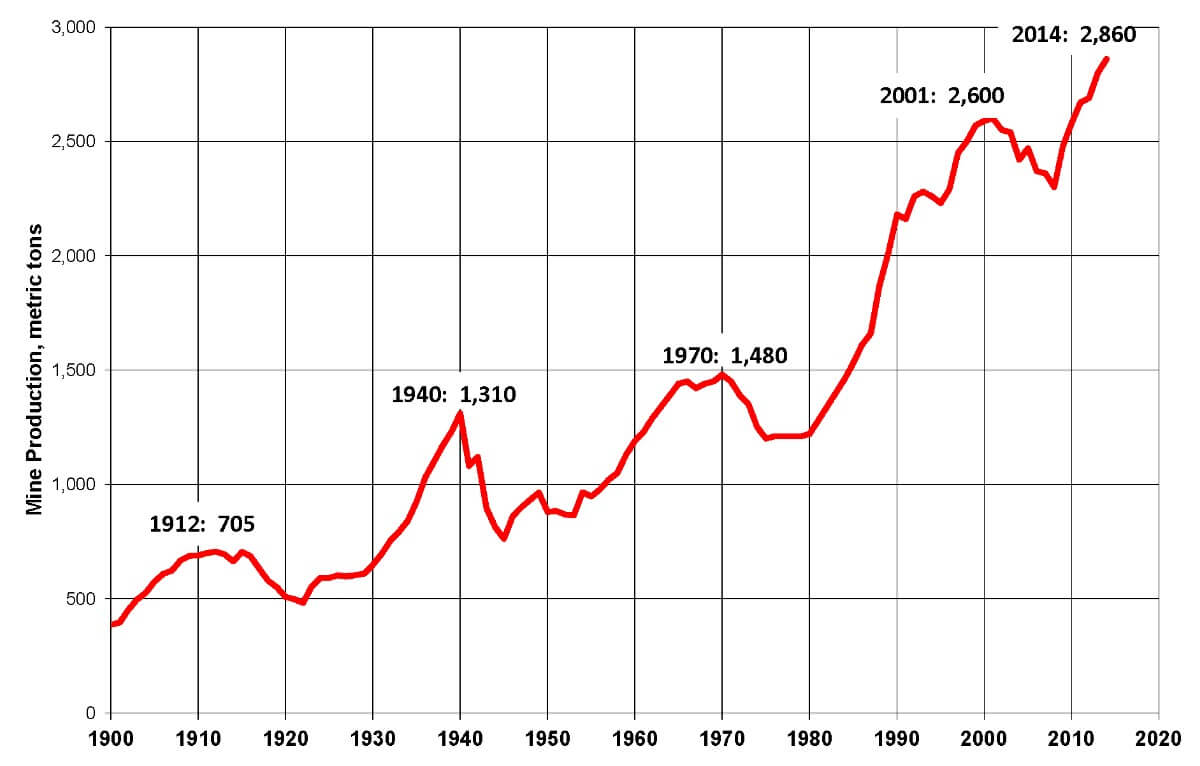

The chart below shows the amount of gold mined every year. As we can see the variability of gold production is relatively low. From 2000 to 2010 the amount of gold mined has been generally been within a range of 200 tons, which represents 0.12% of the total stock of gold. At the same time gold prices have increased almost 4 fold. Therefore, it is difficult to make the argument that mining production variability has been behind the increase in gold prices over the last decade. However, that doesn’t necessarily mean that large changes to mining production couldn’t potentially impact prices, which brings us to our next observation.

The potential impact of mining supply shocks on the price is insignificant

Lets try to measure the price impact of buying/selling the entire yearly mining production of gold in the open market. In the last decade there have been an average of 2600 tons of gold mined every year. How long would it take for us to buy this much gold in the open market without significantly impacting the price?

The primarily market for gold is the London Bullion Market Association (LBMA) and even though gold is traded over the counter around the world, most of the trades are cleared in London. In Feb 2011, trades for an average of 750 tons of gold were cleared everyday in this market.* This trading volume implies that the entire amount of gold mined every year is traded at the LBMA in 3.4 days.

Assuming a trader can likely trade ~5% of the daily volume in a market by not actively taking liquidity and being passive (i.e not crossing the bid-ask spread). This means that someone could buy the entire mining production in the world on the LMBA in 70 days without significantly impacting the price (there would still be some price impact, as the buyer would be accumulating gold even though he might not actively be taking liquidity, but it would be relatively minimal). Therefore, it is hard to argue that shocks to the mining supply of gold are important to gold prices.**

Gold is widely seen as a store of value

One thing that is clear from the distribution of gold demand is that most people demanding gold are looking for a store of value. Private investors and even central banks generally hold gold as a way of preserving their wealth. This is even true for the majority of people who buy gold in the form of jewelry. In the countries that demand the most jewelry (India, China and the Middle East) it is seen as a way of saving money. So when people are generally looking for a store of value they are likely to compare the attractiveness of gold to that of paper currencies.

Conclusion

When trying to understand the exposure you get by buying/selling gold it is important to know what likely does and does not drive the price. It seems reasonable to conclude that when you buy gold you are not getting significant exposure to changes in its mining production or industrial demand.

* This number likely understates the actual amount of gold traded by a factor of 4 or so according to some estimates, because of the way clearing statistics are netted at the LBMA, but for the sake of being conservative we’ll assume that they truly represent the amount of volume traded.

** There are some questions about how the turnover in the LBMA could be such a high percentage of the overall gold stock. One possibility is that the actual amount of gold in the world is much larger than the 165,000 tons that are accounted for.

Sources:

-Gold stock and demand and supply figures from GFMS

-LBMA traded volume figures from LMBA website

-Silver industrial usage figure from World Silver Survey

-Assumption that someone can trade 5% of volume and not impact the market based upon experience